Is a 50-Year Mortgage Really the Answer? A Sacramento realtor’s Perspective

There’s been talk of 50-year mortgages entering the housing market. It’s proposed as a way to make the monthly payment feel more manageable, especially in areas like Sacramento, Rocklin, Roseville, and Folsom, where prices have climbed and buyers are looking for any way to get a toehold in.

Lower payments can feel appealing. But it’s worth taking a closer look at what you’re trading in exchange for that relief.

Let’s use a simple example:

Home price: $500,000

Down payment: 20%

Loan amount: $400,000

Interest rate: 6%

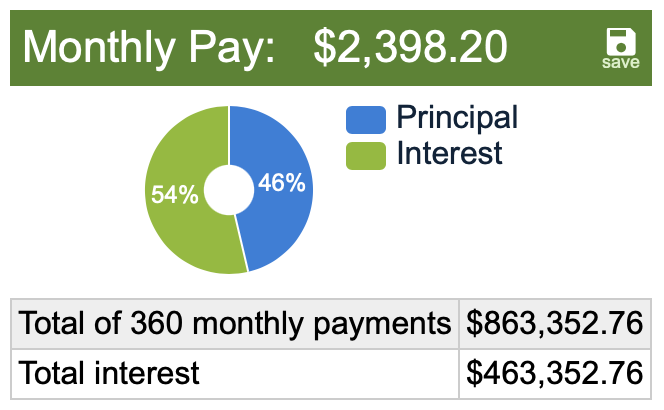

30-year mortgage:

Monthly payment: about $2,398

Estimated interest paid over the full loan term: ~$463,353

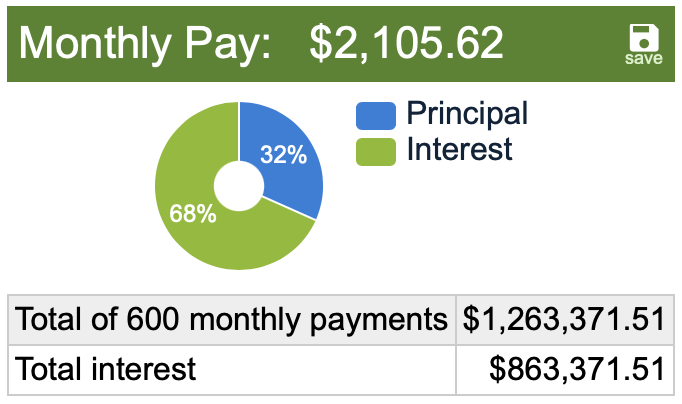

50-year mortgage:

Monthly payment: about $2,106

Estimated interest paid over the full term: ~$863,372

So the monthly difference is a few hundred dollars. But the long-term cost is about $400,000 in additional interest.

The second trade-off is equity. Equity is your side of the ownership equation. It’s what allows people to move from a smaller starter home in Natomas or Antelope into something larger later on.

After 10 years:

On the 30-year loan, the loan balance is paid down by around $65,000.

On the 50-year loan, the balance is reduced by only about $17,000.

That’s a meaningful difference in how much ownership you build.

Equity building matters because the average first-time homebuyer is already in their late 30s. Stretching repayment out to 50 years could mean still carrying a mortgage well into retirement years, which may not support future flexibility.

And while you’re paying that loan down slowly, you’re still responsible for:

Property taxes

Home insurance

Maintenance and repairs

Potential updates or improvements over time

The lower monthly payment doesn’t reduce those ongoing responsibilities.

If someone is feeling uncertain or thinking about waiting:

It may be more helpful to focus on finding something that fits your life and budget now, rather than holding out for a loan product that might lower the payment but increase the overall financial commitment. Buyers who purchase and begin building equity earlier often find themselves in a stronger position down the road than those who wait.

This isn’t to say a 50-year mortgage is “bad” across the board. It simply asks for a careful look at the long-term trade-offs, especially in a market like Sacramento, where many people eventually hope to move up or relocate as needs change.

A home should support your life, your stability, and your goals. The loan attached to it should do the same.

Source: Payment and interest estimates based on standard amortization calculations (Mortgage Amortization Calculator, Calculator.com).